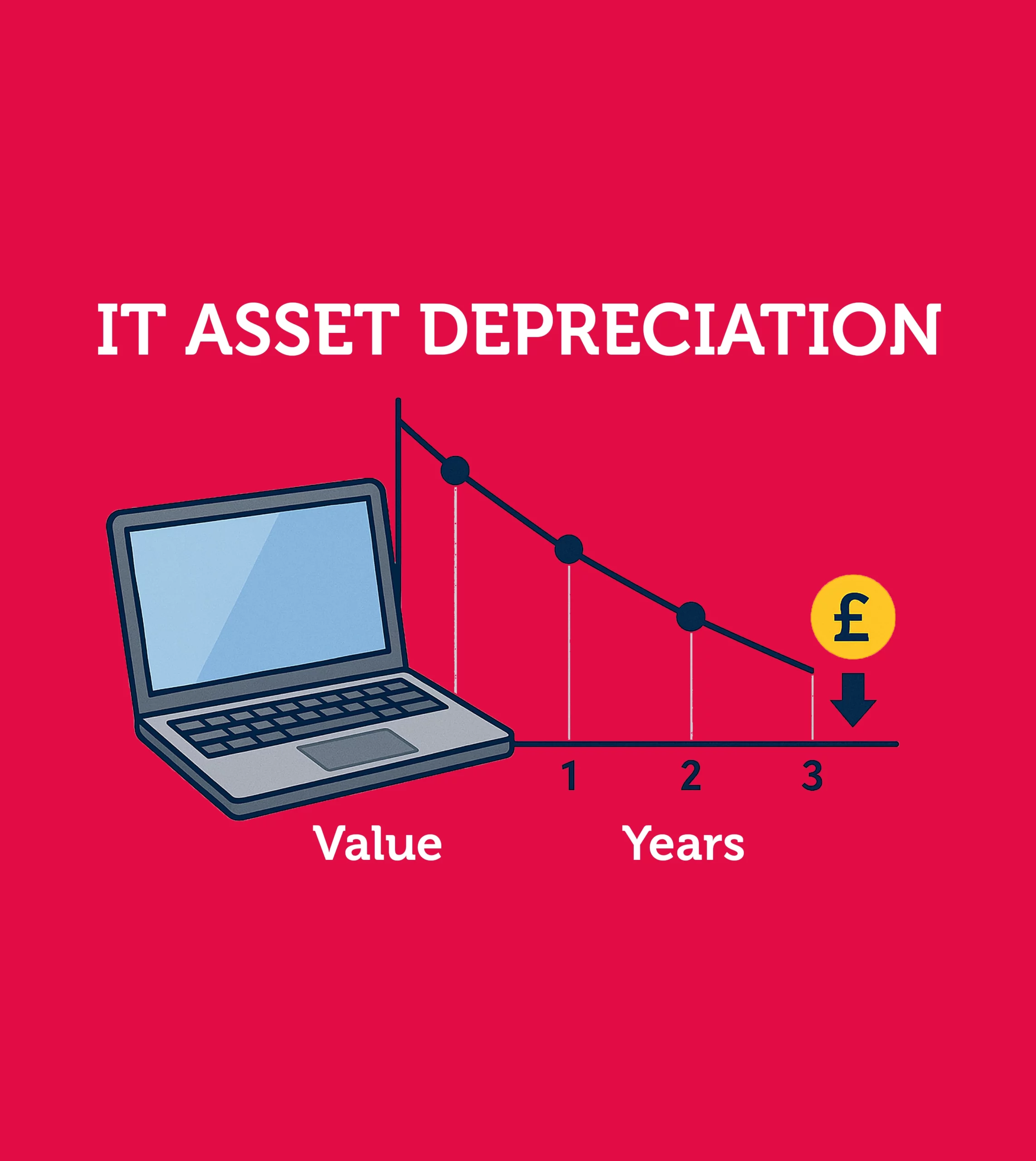

When businesses invest in IT assets, from laptops and servers to software and networking equipment, they’re acquiring more than just devices and technology for daily operations. These devices represent long-term investments with values that diminish over time.

Enter depreciation: a concept that’s far more than an accounting requirement. Calculating the depreciation of IT assets properly is fundamental to accurate financial reporting, strategic planning, and compliance. But how do you go about doing it right?

In this guide, we’ll walk through what IT asset depreciation is, why it matters, how to calculate it, and how Restore Technology can support you with secure, efficient, and sustainable lifecycle management.

What is IT asset depreciation?

All assets eventually diminish in value over their lifetime. Put simply, any IT asset will be worth less years after you’ve bought it than when it was new. IT assets don’t get fully “consumed” in a single accounting period. Instead, they lose value incrementally due to factors such as wear and tear and obsolescence.

This loss of value should be recorded for tax and financial reporting purposes so organisations can spread the initial cost of the asset over a few years. For example, a laptop that costs £1,500 might be depreciated over a three-year period, depending on its expected usage and technological lifespan.

Depreciation also reflects the realistic value of an asset at any given time. For businesses upgrading IT systems (which happens more frequently) or considering resale or disposal, understanding that residual value is key to good decision-making.

Why is it important to understand IT asset depreciation?

Financial reporting: Depreciation directly affects profit and loss statements, so understating or overstating it can distort financial health.

Tax compliance: HMRC allows certain depreciation deductions under capital allowances. Calculating this accurately ensures businesses claim the right relief.

IT asset management: Knowing when an asset will reach the end of its useful life helps with budgeting for upgrades and replacements.

Sustainability and disposal: Assets nearing the end of their depreciation lifecycle might still hold residual value for resale or recycling, contributing to environmental goals.

Depreciation methodologies for IT assets

This is the most straightforward and commonly used method and is particularly suitable for IT assets with a predictable and even rate of usage. It’s ideal for businesses looking for simplicity in accounting and those with stable refresh cycles.

Best used when:

- The asset is expected to provide consistent value over time

- You want steady expense recognition each year

- Your IT refresh cycle aligns with the asset’s useful life (e.g., 3–5 years)

It’s perfect for desktops, printers, and standard workstations in environments where performance demand is stable. A law firm or public sector department with low variability in tech usage will benefit from the predictability of straight-line depreciation.

Formula: (Original Cost – Residual Value) / Useful Life

Example:

A server costing £5,000 with a 5-year useful life and £500 salvage value would depreciate at: (£5,000 – £500) / 5 = £900 per year

This accelerated method depreciates assets more heavily in the earlier years of their life. It’s particularly relevant for fast-depreciating tech like tablets, smartphones, or specialist devices with short innovation cycles.

Best used when:

- The asset quickly loses value due to rapid obsolescence

- You need to front-load depreciation for tax or cash flow reasons

- The asset’s resale value is low or insignificant

It’s ideal for tech-driven organisations, such as marketing agencies using high-end creative tools or fintech companies relying on constantly evolving client-side devices.

Formula (Double Declining Balance): 2 × Straight-Line Rate × Book Value at Start of Year

Though less commonly applied to IT, this method is particularly appropriate where asset value is directly tied to usage and output rather than being strictly time-based.

Best used when:

- The asset’s wear is based on measurable usage (e.g. compute hours, user sessions)

- You want depreciation that reflects workload, not the calendar

This method is great for data centres or cloud service providers running high-performance machines. If one server is maxed out while another is idle, this approach captures that nuance financially.

Formula: (Asset Cost – Residual Value) / Estimated Total Units of Production × Units Used in Period

This method requires accurate usage tracking, something Restore Technology can support with integrated IT asset management platforms.

A hybrid of straight-line and accelerated depreciation, SYD applies a declining scale of depreciation, just at a slower rate than the declining balance method.

Best used when:

- The asset provides more utility early on but still retains long-term relevance

- You want a method between straight-line and full acceleration

This method is best suitable for devices that offer early performance advantages but stay in limited use as backups or in secondary roles, like enterprise routers or non-critical servers after a refresh. This method is slightly more complex than straight-line, but often manageable with accounting software or IT asset tools.

Many organisations have mixed-use IT portfolios, meaning one method won’t fit all. In practice:

- Use units of production for computer-intensive or pay-as-you-go systems

- Use straight-line for general office devices

- Use declining balance for customer-facing or innovation-critical assets

- Use units of production for computer-intensive or pay-as-you-go systems

Optimise Asset Value with Tailored Hybrid Depreciation Strategies

At Restore Technology, we help you implement hybrid depreciation strategies. We’ll assess your IT estate, understand usage patterns, and work with your finance team to ensure each asset is aligned with the right methodology. This results in better forecasting, more compliant reporting, and improved ROI over your assets’ lifecycle.

When best to use the different methodologies

| Method | Ideal For | Pace of Depreciation | Complexity | Best Use Case Example |

Straight-Line | Standard office hardware | Evenly spaced | Low | Laptops with 3-year cycles |

Declining Balance | Rapidly obsolescing tech | Front-loaded | Medium | High-turnover mobile devices |

Units of Production | Usage-based assets | Usage dependent | High | High-utilisation servers |

Sum-of-the-Years’ Digits | High initial utility, long lifespan | Gradual acceleration | Medium | Custom routers or hybrid servers |

How hardware and software depreciation differ

Hardware

Laptops, desktops, servers and similar equipment tend to follow the straight-line or declining balance method. These assets have tangible wear and a relatively predictable shelf life, typically between 3 and 5 years.

Software

Off-the-shelf software is usually capitalised and amortised over its useful life, often 3 to 7 years. With the rise of SaaS models, however, many software solutions are now treated as operational expenses rather than capital investments. This subtle shift significantly impacts how companies calculate and track software “depreciation”. Restore Technology’s experts work with your finance and IT teams to categorise assets correctly so that the right depreciation model is applied.

How to calculate the depreciation of IT equipment

You’ll need the following:

- Purchase price

- Date of purchase

- Expected useful life

- Residual (salvage) value

- Method of depreciation

This will be based on asset type, business policy, and usage. Most UK businesses use the straight-line method unless there’s a clear case for accelerated depreciation.

Let’s say you bought 100 laptops at £1,000 each and they depreciate over 3 years with a salvage value of £100.

- Total cost: £100,000

- Residual: £10,000

- Depreciation per year = (£100,000 – £10,000) / 3 = £30,000

Use IT asset management software to keep a live record. Ensure compliance with accounting standards and maintain a clear audit trail, something Restore Technology can help implement across your end-to-end operations.

Best practice tips for managing IT depreciation

Depreciation starts with knowing what you have. That means building and maintaining a detailed inventory of every device, from laptops and monitors to servers and specialist software licenses. Don’t just stop at the purchase date and cost either. Include warranty expiry dates, assigned users, physical location, current condition, and the depreciation schedule for each item. A live, dynamic asset register is your foundation for smarter financial planning and can save countless hours during audits or budget reviews.

A piece of kit that felt cutting-edge three years ago might be sluggish and unreliable today. And in sectors like finance or creative media, ‘functional obsolescence’ can arrive even sooner. That’s why it’s critical to reassess your IT assets every year. Are those desktops still meeting the needs of your team? Is that legacy server costing more to maintain than it’s worth? By updating useful life estimates annually, you ensure your depreciation reflects the true business value, not just the balance sheet figure.

Modern businesses need integrated solutions that tie asset tracking, depreciation scheduling and IT performance into one platform. Restore Technology’s asset management systems provide exactly that, a single source of truth that links finance, procurement, and IT. You’ll know what you own, where it is, what it’s worth, and when it’s due for replacement, all at a glance.

Too often, disposal is an afterthought. But the most sustainable businesses build their exit strategy at the point of purchase. When choosing new tech, ask: Can this be resold? Is it easy to refurbish? Are there recycling options for end-of-life components? Thinking ahead reduces waste and enhances your sustainability credentials. With Restore Technology’s zero-landfill IT disposal service, you’re embedding responsible lifecycle management across the entire organisation.

If your organisation refreshes devices every three years, but your finance team is depreciating them over five, your balance sheet isn’t telling the full story. Misalignment like this can distort replacement planning, understate write-down costs, and throw off your budgeting cycles. Instead, depreciation policies should mirror real-world usage. Work closely with IT and finance so that schedules are practical, consistent, and reflective of how assets are truly consumed.

How Restore Technology can help

Restore Technology is your end-to-end partner in IT lifecycle management. From procurement through to end-of-life, we help businesses optimise asset value, stay compliant, and meet sustainability goals without compromising on security.

Unlike providers who only handle disposal, we support your full depreciation strategy with services that are integrated, traceable, and built around your real-world needs.

- Full audit trails: Every asset is tracked with a complete, tamper-proof audit trail, from collection through to final disposal. Perfect for financial reporting, compliance checks and peace of mind.

- Tailored depreciation strategies: We help align your depreciation schedules with your actual IT usage and refresh cycles so that your accounts accurately reflect asset value.

- Certified Data Destruction: Our ADISA- and NAID-certified services guarantee that sensitive data is securely erased or physically destroyed, with certificates for your records.

- Secure logistics: With GPS-tracked vehicles and DBS-checked staff, your equipment will be collected, transported, and processed under strict chain-of-custody protocols.

- No-landfill Policy: We refurbish, repurpose, or recycle wherever possible, supporting your ESG goals while ensuring full WEEE compliance.

Managing IT assets responsibly

The depreciation of IT assets is ultimately about getting a true picture of asset value, planning better IT refreshes, and staying compliant with financial standards. Whether you’re a small business with a few devices or a global enterprise with thousands, calculating IT depreciation accurately can drive smarter financial decisions.

The UK's leading IT asset lifecycle services company

Restore Technology is here to guide you every step of the way, offering insight, tools, and services that make IT asset management something you can feel confident about. To find out more, contact us on 0333 060 1920 or request a quote today.